Gate Research: BTC Sets New Record, Surging Past $124,000 | Tom Lee Announces $20 Billion Capital Raise to Increase ETH Holdings

Summary

- This week, Bitcoin (BTC) broke above $124,000 to set an all-time high, while Ethereum (ETH) surged 12.02%. Major altcoins also posted strong gains across the board.

- Chainlink and ICE announced a strategic collaboration to integrate top-tier global FX and precious metals data into on-chain applications.

- BitMine Immersion unveiled plans to raise up to $20 billion to increase its ETH holdings, underscoring robust institutional confidence in ETH's long-term outlook.

- Total crypto market capitalization soared to a new record of $4.21 trillion, with Bitcoin's market cap surpassing Alphabet to claim the fifth spot globally.

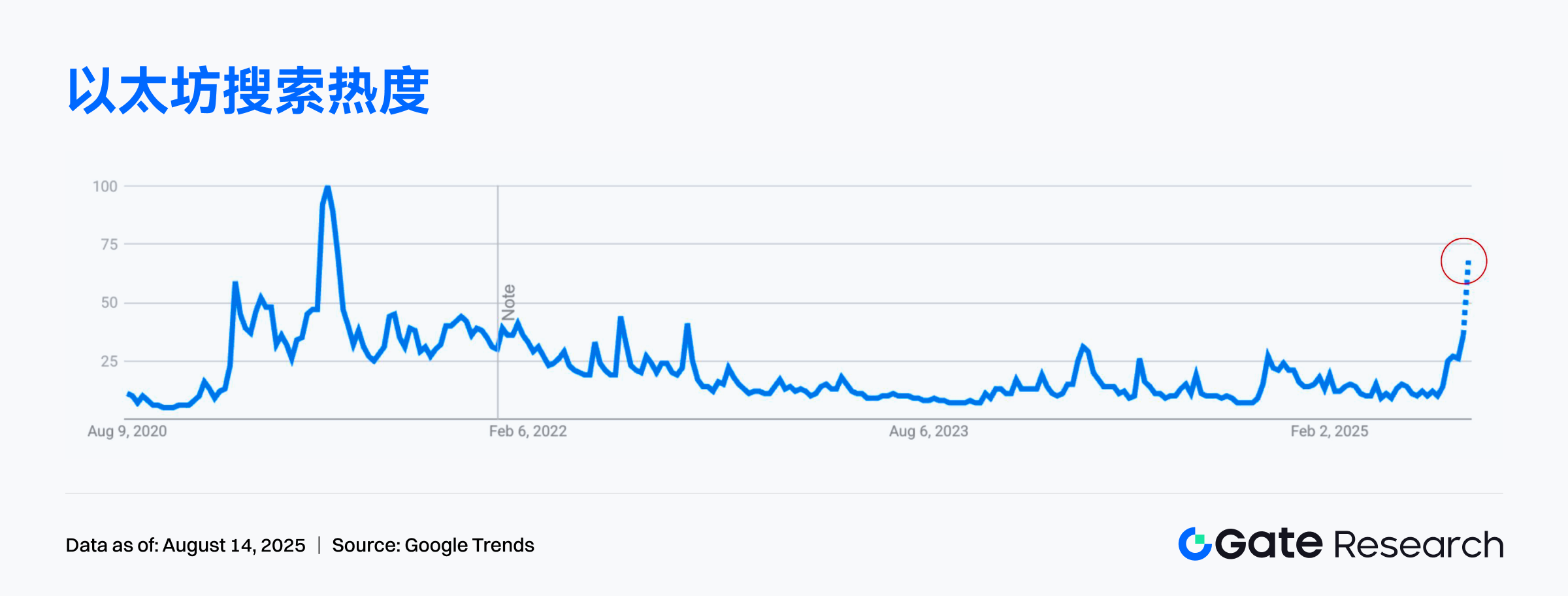

- Ethereum searches just hit their highest levels since 2021, with price and on-chain activity rising in tandem.

- Base’s daily DEX trading volume surpassed $2 billion, pushing on-chain activity to a new cycle high.

Market Commentary

Market Performance Review

- BTC — BTC advanced 3.61% this week. Prices fluctuated near $120,000 early on, then climbed steadily through subsequent sessions. On August 12, BTC saw a sharp pullback from around $124,000 to below $118,000 as trading volumes spiked, suggesting profit-taking pressure. Bulls quickly recovered, and on August 14, BTC decisively broke to new highs, reaching $124,497. At last check, BTC traded at $123,516.61, retaining strong momentum.

- ETH — ETH jumped 12.02% this week. The price consolidated near $4,220 early in the week, faced brief selling, then surged on August 12 with an intraday gain near 8.7%, breaking above the $4,600 mark. Continued bullish sentiment propelled ETH to a local peak of $4,783—just about 3% shy of its all-time high. Robust trading volumes indicate active capital flows. As of now, ETH is at $4,750.92, reflecting strong breakout potential.

- Altcoins — Blue-chip altcoins delivered broad-based gains, with major L1 tokens up over 10% on average. Over the past 7 days, among the top 100 crypto assets, LDO climbed 60.34%, PENDLE rose 40.06%, and ADA jumped 33.33%, drawing considerable market attention.

- Macro — Markets widely expect the Fed to cut rates in September, with debate around a 25- or 50-basis-point move. U.S. Treasury Secretary Scott Besant publicly backed a more aggressive 50-basis-point cut and signaled further easing may follow. This catalyzed a global rally, with U.S. equities—particularly the S&P 500, Nasdaq, and Dow—setting fresh records.

- Stablecoins — Total stablecoin market capitalization now stands at $269.5 billion, with USD1 and USDE among those fueling considerable market interest.

- Gas Fee — Ethereum network gas fees trended higher this week, with average fees reaching 0.649 Gwei on August 14.

Trending Themes

Major cryptocurrencies continued their rally this week, sustaining positive market sentiment. Most major altcoin sectors posted robust gains. Coingecko data shows that over the last 7 days, oracles, chain abstraction, and cross-chain messaging protocols all outperformed, up 39.3%, 38.3%, and 38.1%, respectively.

Oracles

Oracles securely deliver off-chain data to blockchain smart contracts, bridging real-world information with decentralized applications. They provide vital data for DeFi, prediction markets, and more, elevating contract automation and transparency. The oracle sector surged 39.3% in the past 7 days, led by Chainlink (+43.6%) and Nest Protocol (+142.2%).

Chain Abstraction

Chain abstraction standardizes blockchain interfaces, enabling developers to build DApps without worrying about inter-chain differences and unlocking efficient multi-chain interoperability. Lower development barriers and enhanced scalability are key value propositions, supporting the free flow of cross-chain assets and data. The sector advanced 38.3% over the past week, with Near Protocol up 22.2%.

Cross-Chain Messaging Protocols

Cross-chain messaging enables secure, high-speed data and asset interactions between blockchains. This bolsters ecosystem interoperability, asset liquidity, and application efficiency, paving the way for seamless, multi-chain DApp operations. The sector was up 38.1% in the past 7 days, with Soon and HyperSwap AI gaining 116.2% and 75%, respectively.

Weekly Spotlight

BitMine Immersion Aims to Raise $20 Billion for ETH Accumulation

BitMine Immersion Technology (BMNR), led by Fundstrat co-founder Tom Lee, announced plans to raise up to $20 billion via equity sales to acquire more ETH. As of August 10, the company held approximately $5 billion in ETH, nearing 5% of its target share of ETH’s total supply. Previously, BMNR completed $4.5 billion in equity sales through Cantor Fitzgerald and ThinkEquity, with most shares already placed and $723 million still available. This aggressive accumulation marks BMNR's expanding digital asset strategy—pivoting from bitcoin mining to a growing focus on ETH.

This move highlights sustained institutional conviction in ETH’s long-term value. As institutional deployment of crypto assets accelerates, BMNR's initiative not only underscores ETH’s strategic importance as a core digital asset, but also exemplifies a new trend: leveraging traditional capital markets to participate in the crypto sphere.

Grayscale Registers Cardano and Hedera Trusts in Delaware, Potentially Launching the First Publicly-Traded Altcoin ETFs

Grayscale, the digital asset management giant, registered Cardano Trust ETF and Hedera Trust ETF entities in Delaware—a standard precursor to submitting S-1 filings and launching a U.S. ETF. This move coincides with surging market interest in altcoin ETFs, spurred by recent SEC efforts to clarify digital asset classifications.

While Grayscale has previously managed Dogecoin, Filecoin, and Avalanche trusts for private placement, Cardano and Hedera trusts, if their S-1s are approved, could become the world’s first public altcoin ETFs. This would broaden Grayscale’s institutional and retail offering just as the crypto ETF market accelerates in the wake of successful Bitcoin and Ethereum spot ETFs. Grayscale’s latest filings show clear ambition to lead in diversified and regulated crypto investment products.

Chainlink Partners with ICE to Onboard FX and Precious Metals Data On-Chain

Chainlink, the leading blockchain oracle network, announced a landmark partnership with Intercontinental Exchange (ICE) to bring premium global FX and precious metals data on-chain. ICE, a major global financial institution and parent company of the NYSE, runs multiple exchanges and clearinghouses and provides mission-critical market data worldwide. Through this partnership, Chainlink will integrate ICE’s Consolidated Feed—delivering secure, reliable multi-asset data from over 300 exchanges and markets to on-chain applications.

This will give DeFi, on-chain derivatives, and allied financial applications access to data at the same quality level top banks and asset managers use, improving on-chain market reliability and efficiency. In its Q2 2025 report, Chainlink also showcased ecosystem expansion including Chainlink Reserve (LINK reserves backed by on- and off-chain revenue) and CCIP’s integration with Solana, underlining its continued leadership in blockchain infrastructure.

Key Metrics

Crypto Market Cap Sets New Record at $4.21 Trillion; Bitcoin Market Cap Surpasses Alphabet, Ranks Fifth Globally

Per CoinGecko, total crypto market cap has surpassed $4.21 trillion for a fresh all-time high, up 3.5% in 24 hours. Bitcoin also hit new price records, propelling its market cap to $2.45 trillion—overtaking Alphabet (Google’s parent company) and placing fifth on 8marketcap’s global asset leaderboard. This milestone spotlights digital assets’ rising influence in global finance and underscores how institutional flows and macro expectations drive the market.

The rally is fueled by Bitcoin’s price breakout boosting market beta, strong net inflows into spot ETFs, and surging on-chain activity and efficiency from Ethereum and Layer 2 networks. Going forward, monitor spot ETF net flows, futures open interest and funding rates, stablecoin inflows, and on-chain activity for cues on market sustainability and health.

Ethereum Search Interest at Highest Since 2021, Price and On-Chain Activity Rising Together

Google Trends shows that "Ethereum" searches have hit their highest levels since 2021, while "altcoin" searches are at a five-year high—evidence that investor interest is broadening beyond the blue chips. ETH broke above 4,300 USDT and consolidated in the 4,500–4,670 range, marking a near four-year high as on-chain activity soared—single-day transactions reached a record 1.87 million. Combined with ETF holdings and institutional inflows, these provide solid capital and fundamental support for ETH’s price.

Historically, spiking search volumes signal amplified retail participation, while record "altcoin" searches point to capital and sentiment rapidly rotating toward smaller assets. As demand for Ethereum in payments, DeFi, and application ecosystems grows, price and fundamentals reinforce each other. The broader altcoin market should also benefit from this uptick in risk appetite, supporting prolonged structural rallies. For now, both retail momentum and institutional flows are powering the market, suggesting further upside potential in the near term.

Base DEX Trading Volume Surpasses $2 Billion Daily, On-Chain Activity Reaches New Highs

Dune Analytics reports Base’s DEX trading volume broke $2 billion in a single day for the first time, setting a new local record and highlighting its dominance in Layer 2 trading volumes and liquidity. The surge signals returning risk appetite and showcases Base’s advantage in transaction costs and speed.

Aerodrome led Base’s 24-hour DEX volume with $879 million (over 40% of the total), while Uniswap followed at $626 million. Combined, these top two protocols accounted for more than 70% of Base’s total DEX activity, indicating a strong concentration of capital in leading platforms.

This spike in trading may be driven by renewed interest in hot tokens, continued rollout of ecosystem projects, and cross-chain inflows. Thanks to low fees, Base is steadily attracting high-frequency traders and liquidity providers, deepening order books and ramping up activity. If this momentum holds, Base could continue growing its share within Ethereum’s Layer 2 ecosystem and reshape the DEX landscape.

Funding Highlights

RootData shows that from August 8 to August 14, 2025, 15 crypto and related projects completed funding or M&A deals spanning Ethereum treasury management, Web3 infrastructure, crypto payments, on-chain gaming, and AI applications. This reflects the industry’s ongoing investment in asset allocation, foundational infrastructure, and user ecosystem growth. Here are the top three projects by fundraising scale this week:

180 Life Sciences Corp

On August 11, 180 Life Sciences completed a $425 million PIPE round to launch an Ethereum treasury strategy.

The company aims to drive long-term capital growth via Ethereum allocation and on-chain yield—pursuing diversified strategies like staking, lending, and liquidity provision to outperform traditional ETH staking. Proceeds will fund direct ETH purchases and delegated yield management by Electric Capital.

SharpLink

On August 11, SharpLink signed a securities purchase agreement with five top-tier global institutions, completing a $400 million registered direct offering.

SharpLink focuses on Ethereum-based asset allocation and treasury management, combining spot positions, on-chain yield plays, and structured capital solutions to offer institutional investors diversified, liquid Ethereum exposure. As of August 10, SharpLink held about 598,800 ETH and $200 million in unallocated funds, for total ETH positions exceeding $3 billion.

Heritage Distilling

On August 11, Heritage Distilling closed $220 million in funding from investors including a16z crypto and Amber Group.

The company is building a digital asset reserve and value management system around IP tokens, targeting long-term capital growth and digital transformation of brand assets. $82 million will be allocated to direct IP token purchases as strategic reserves for future ecosystem expansion.

Next Week’s Watchlist

Token Unlocks

Tokenomist data indicates that from August 15–21, 2025, several major token unlocks are scheduled. The top three are:

- FTN will unlock about $91.5 million in tokens, equal to 2.08% of circulating supply.

- ZRO will unlock $59.9 million worth, representing 8.53% of supply.

- CONX will unlock tokens valued at approximately $58 million, or 3.10% of circulating supply.

Sources

- Gate, https://www.gate.com/trade/BTC_USDT

- Gate, https://www.gate.com/trade/ETH_USDT

- Coinmarketcap, https://coinmarketcap.com/

- Farside Investors, https://farside.co.uk/btc/

- Coinglass, https://www.coinglass.com/LiquidationData

- jin10, https://rili.jin10.com/

- Coinmarketcap, https://coinmarketcap.com/view/stablecoin/

- Coinmarketcap, https://coinmarketcap.com/community/articles/689c1ba16529dc757c160eb1/

- Coinmarketcap, https://coinmarketcap.com/community/articles/689c66c625f4777113d89d90/

- etherscan, https://etherscan.io/gastracker

- Coingecko, https://www.coingecko.com/en/categories

- X, https://x.com/MarcShawnBrown/status/1955507198814990404/photo/1

- CoinGecko, https://www.coingecko.com/en/global-charts

- 8marketcap, https://8marketcap.com/

- X, https://x.com/jessepollak/status/1955268199294849382

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

- Coindesk, https://www.coindesk.com/business/2025/08/12/tom-lee-s-bitmine-aims-to-raise-as-much-as-usd20b-for-more-eth-buys

Gate Research Institute is a comprehensive platform for blockchain and crypto research, delivering deep-dive analysis, market reviews, industry research, trend forecasts, and macro policy insights for our readers.

Disclaimer

Investing in cryptocurrencies involves significant risk. Users should conduct independent research and fully understand the nature of the assets and products involved before making any investment decisions. Gate accepts no liability for losses or damages arising from such investment decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

How to Do Your Own Research (DYOR)?

What Is Technical Analysis?

What Is Fundamental Analysis?