SUI Price Prediction: Is a 400% Surge to $13.76 on the Horizon?

SUI may迎来新一轮rise

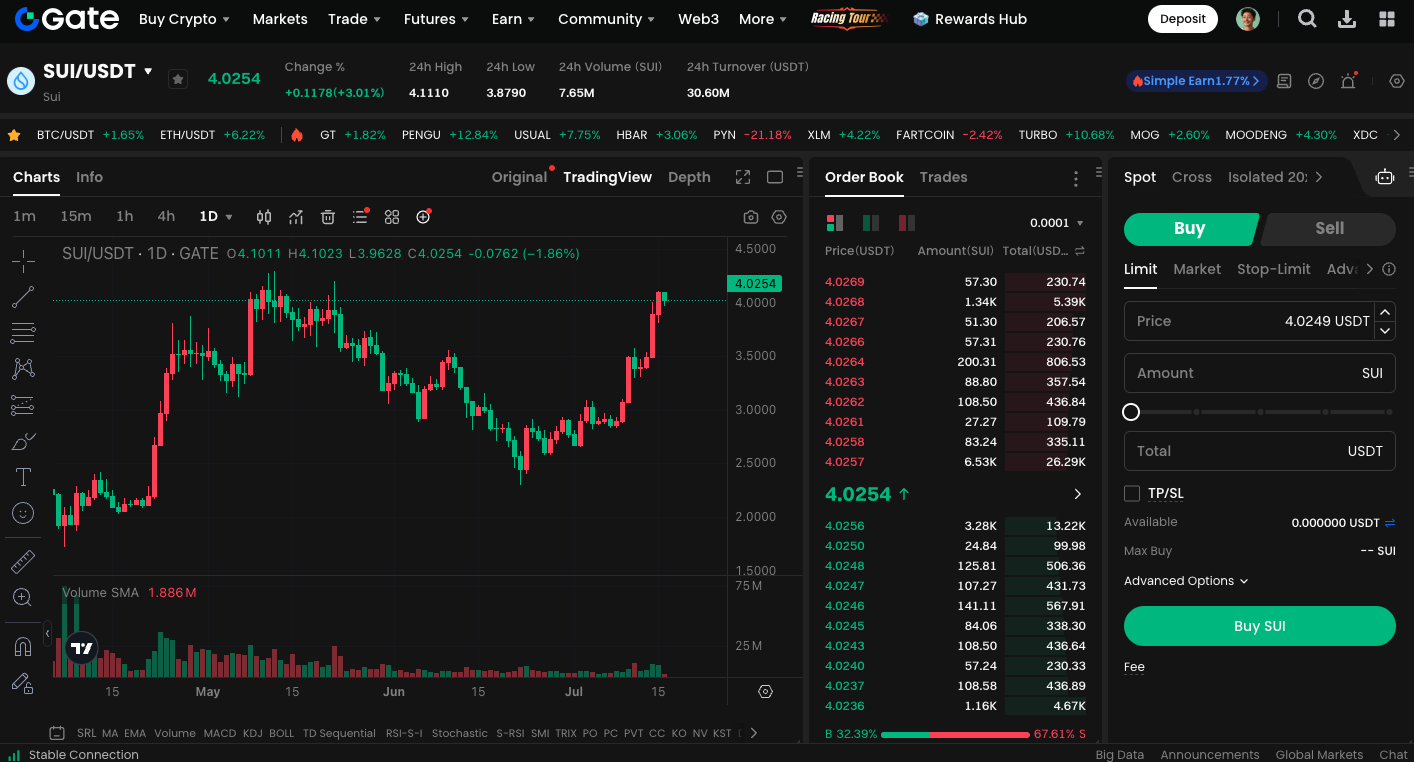

As the cryptocurrency market gradually warms up, SUI’s technical chart has also shown clear bullish signals. Noted market observer Ted Pillows recently pointed out that SUI is standing on the brink of a possible explosion, with its price structure and indicators displaying potential “parabolic rise.” On the weekly level, SUI maintains a healthy oscillation within an upward channel, with its price recently pulling back from a high near 5 dollars to 2.5 dollars, and then rebounding again, demonstrating quite resilient support structure.

(Source: TedPillows)

The MACD indicator of SUI is about to form a bullish golden cross. According to historical patterns, the last time a similar technical formation appeared, the price soared over 400% within the next six months. If the trend repeats, the potential target price for SUI may reach around 13.76 USD.

Positive fundamentals for SUI are emerging

In addition to technical analysis providing positive signals, the fundamentals of SUI are also rapidly strengthening. Recently, institutions including Grayscale, Canary Capital, and 21 Shares have successively applied for products related to SUI spot ETFs, bringing the market’s attention back to this Layer 1 public chain with strong scalability and technological innovation.

One of the biggest highlights of Sui in terms of technological innovation is its parallel transaction processing architecture. Most traditional smart contract platforms adopt a linear transaction processing model, while Sui can process multiple transactions simultaneously, significantly improving processing efficiency. For simple operations, it can even bypass the consensus mechanism for immediate completion. Sui uses an upgraded version of the Move language (derived from Rust), which makes its smart contracts faster and more secure. These architectural foundations inject real use value into the SUI token, supporting staking and gas fee payments.

Potential Impact of Token Unlocking and Market Observation

The unlocking of 44 million SUI tokens on August 1 has attracted significant attention from market investors, as it accounts for approximately 1.27% of the circulating supply and could impact short-term price fluctuations. Although the unlocking may bring some selling pressure, the actual effect still depends on the distribution of the unlocked tokens and their intended use. If most tokens flow into long-term incentive mechanisms or ecological funds, the selling pressure on the market may be limited; conversely, if a large number of tokens enter exchanges post-unlocking, it may lead to a price correction in the short term. The community generally advises investors to closely monitor official announcements and on-chain flow changes to grasp potential opportunities and risks.

Start trading SUI spot immediately:https://www.gate.com/trade/SUI_USDT

Summary

SUI not only has a leading technological advantage, but its market recognition and capital flow are also gradually being established. Considering various technical and fundamental factors, if it breaks through key resistance levels and stabilizes, a target price of 13.76 dollars is not out of reach. The coming weeks to months will be a critical time to observe whether SUI enters a main upward phase.