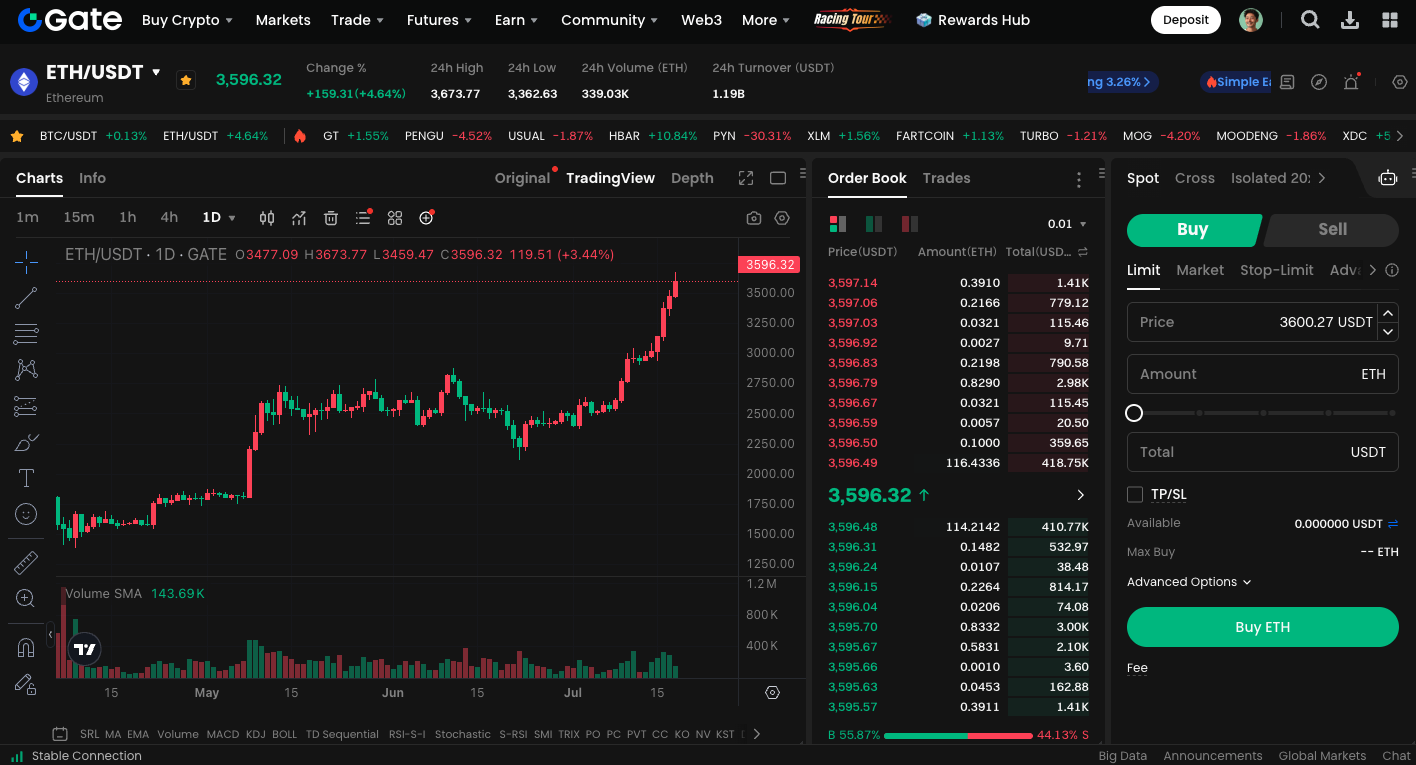

Ethereum Price Prediction: Institutions Rush to Buy ETH as Weekly Gains Top 20%

ETH Weekly Gains Exceed 20%

Over the past week, Ethereum (ETH) recorded an increase of more than 20%, surpassing the $3,600 mark. This has coincided with a notable uptick in institutional capital inflows. Recent data indicates that several companies, including SharpLink Gaming and BitMine Immersion Technologies, have expanded their ETH holdings to over $1 billion, underscoring the growing trend of ETH becoming a core digital asset for institutions.

SharpLink and BitMine Increase Ethereum Holdings

The analytics platform Lookonchain reports that SharpLink has acquired more than 140,000 ETH—valued at over $500 million—in the past nine days, bringing its total ETH holdings above $1 billion. The company has submitted an updated prospectus to the U.S. Securities and Exchange Commission (SEC), proposing to raise $5 billion through a new share issuance to further increase its ETH holdings and support business growth.

BitMine, with support from analyst Tom Lee, has also announced holdings of more than 300,000 ETH, valued at over $1 billion. The company aims to eventually hold 5% of Ethereum’s total supply and participate in network consensus and staking activities to generate returns.

Public Markets and Bitcoin Mining Firms Shift Toward ETH

In addition to these companies, GameSquare Holdings has completed a $70 million public fundraising round and plans to establish a $100 million ETH treasury. Bitcoin mining company BTC Digital has announced it will convert its BTC holdings entirely into ETH, reflecting a broader shift in institutional asset allocation strategies.

Why Is ETH Attracting Increased Institutional Attention?

Ray Youssef, CEO of NoOnes, stated that institutions view ETH not only as “digital oil” but also as on-chain financial infrastructure that meets regulatory requirements. He noted that tokenized asset management on the Ethereum network now exceeds $5 billion, covering real-world assets (RWAs) such as government bonds and stablecoins. ETH is becoming a key foundation for financial technology innovation.

Jamie Elkaleh, Chief Marketing Officer of Bitget Wallet, added that Ethereum’s current appeal lies in its dual role as both a yield-generating asset and the foundational network driving the blockchain economy. For institutions, this represents more than an investment in cryptocurrency; it is an allocation into the broader decentralized finance (DeFi) ecosystem.

ETH spot trading is available at: https://www.gate.com/trade/ETH_USDT

Conclusion

A growing number of companies are incorporating ETH into their balance sheets and operational fund allocations, indicating a shift from Bitcoin’s sole position as a store-of-value toward ETH’s combined roles as an application and yield-generating asset. Over the long term, this trend may reshape the value structure of the cryptocurrency market, and ETH could experience further significant price increases on a weekly basis.

Share

Content