Uncovering the US Compliance Propaganda Trap of Crypto Platforms

Original title reposted: “66. Starting from Mystonks: Exposing the ‘US Compliance’ Marketing Traps of Crypto Platforms”

[Introduction]

A platform called Mystonks, which promotes “tokenizing US stocks,” recently drew widespread criticism for freezing user funds. According to reports, the platform withheld a significant amount of assets, citing “non-compliant sources of user funds.”

From a financial compliance standpoint, this approach is highly unusual. A properly regulated financial institution, when identifying suspicious funds, would standardly reject the deposit and return the funds to the sender, while simultaneously reporting the incident to the authorities. By directly “withholding” assets, the platform’s actions cast serious doubt on its claims of “compliance.”

Mystonks has consistently touted its US MSB registration and compliant STO issuance as its main selling points. But what’s the real story behind these so-called “compliance” credentials? I conducted a thorough investigation.

1. The Truth about “Compliant STOs”: Registration Is Not Authorization, Private Placement Is Not Public Offering

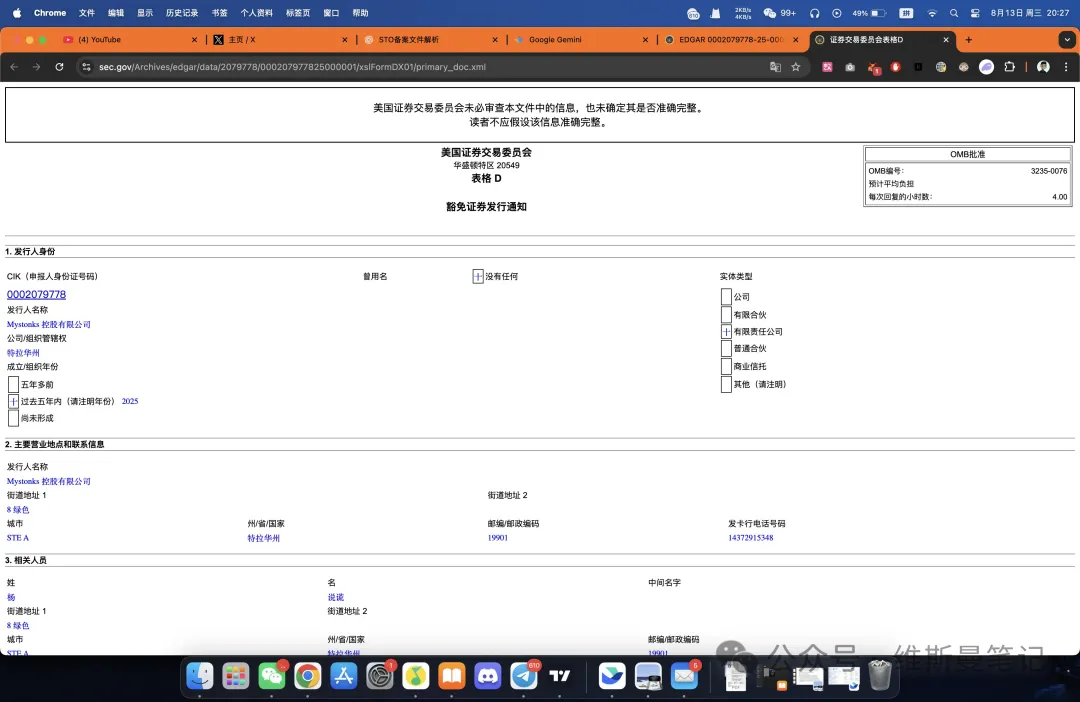

In my research, I found Mystonks’ marketing isn’t entirely unsubstantiated. Mystonks Holding LLC does appear in the public filings database of the US Securities and Exchange Commission (SEC).

The key points from its Form D filing are as follows:

● Filing type: Private offering exemption under Regulation D, Rule 506(c).

● Eligible investors: Only “accredited investors.”

● Fundraising amount: $575,000, with a minimum investment of $50,000.

This document is at the heart of the problem—it’s the most potentially misleading aspect of the platform’s marketing.

First, Form D is a notice filing, not an operational license. All it means is that the company notified the SEC about a private offering. The SEC simply archives this notice—it does not review, approve, or endorse the company’s credentials or the legitimacy of its projects.

Second, and most critically, the filing strictly limits the investor pool. Regulation D is specifically designed for private placements, allowing only a select group of qualified wealthy individuals or institutions (“accredited investors”) to participate. Mystonks, as a platform open to the public, clearly has the vast majority of users who don’t qualify under this standard.

In effect, Mystonks is using a filing meant for small, restricted fundraising among the affluent to conduct public securities trading—a business that requires much stricter licensing.

This approach effectively takes advantage of retail investors’ lack of familiarity with US securities laws, blurring important distinctions. To legally offer security token trading services to the public, a platform needs ATS (Alternative Trading System) or Broker-Dealer licenses—far more rigorous than what a simple Form D provides.

2. The Overhyped MSB Registration: “AML” Compliance That Doesn’t Protect Your Funds

After discussing the complexities of STOs, let’s talk about an even more common marketing tool—the US MSB registration.

Anyone interested in investing needs to recognize a fundamental truth about the MSB registration: its value and importance are greatly exaggerated in crypto project marketing.

The MSB (Money Services Business) registration is overseen by FinCEN, a bureau within the US Department of the Treasury. Its primary mission is anti-money laundering (AML). That is, FinCEN only cares whether platforms report suspicious transactions to combat financial crime; it does not guarantee fund security for users, nor does it vet a platform’s business model or technical capabilities.

Even more telling, an MSB registration is extremely easy and inexpensive to obtain. With the help of intermediaries, projects can complete the registration overseas—no US-based office required. That’s why many projects use an MSB to present themselves as “compliant.”

So, when a platform mostly targeting non-US users keeps highlighting its MSB registration, investors should realize this is a marketing ploy, not real evidence of financial strength or regulatory rigor.

Conclusion: Mystonks Reveals the “Compliance” Playbook Common Among Certain Platforms

Mystonks is not an isolated case. It clearly demonstrates the “compliance packaging” tactics that are widespread among platforms operating in regulatory gray areas. Across the marketplace, countless exchanges and financial service providers follow similar scripts, and investors need to be alert to these patterns.

The typical playbook for these platforms usually looks like this:

- Step 1: Use MSB registration as a marketing “door opener.” By leveraging the perceived “official” US connection and the extremely low entry cost, they quickly craft a basic, superficially credible image.

- Step 2: Misrepresent securities filings through sleight of hand. They repackage a limited, strictly conditioned filing (such as a private placement filing) as a full-fledged license to serve the public, exploiting information gaps for deeper deception.

- Step 3: Exploit geographic and legal divides for targeted marketing. Knowing their business can’t legally operate within the US, they specifically target overseas users unfamiliar with US regulations, creating a situation in which what fails to gain traction domestically may be marketed successfully overseas.

As investors, we must learn from these tactics. When evaluating whether a platform is genuinely compliant, remember two essential principles:

● True compliance is expensive and tangible. It requires paying significant license fees, maintaining deposits, leasing physical office space, and employing local legal teams. If “compliance” is cheap and invisible, its substance is equally thin.

● True compliance is transparent and specific. Legitimate platforms publicly display license type, registration numbers, regulatory scope, and restrictions. Vague, catch-all claims of “compliance” almost never stand up to scrutiny.

When making investment decisions, treat “compliance” as a legal standard that must be rigorously examined—not just a buzzword for marketing. Maintaining this distinction is essential for protecting your assets.

Disclaimer:

- This article was originally published by [Wiseman Notes] under the original title “66. Starting from Mystonks: Exposing the ‘US Compliance’ Marketing Traps of Crypto Platforms.” Copyright remains with the original author [Wiseman Notes]. If you have any concerns about this reprint, please contact the Gate Learn Team; we will address your inquiry promptly in accordance with our procedures.

- Disclaimer: The views and opinions in this article are solely those of the author and do not constitute investment advice.

- All other language versions of this article were translated by the Gate Learn team. Unless Gate is specifically referenced, translated articles may not be copied, distributed, or plagiarized in any form.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge