Who killed Cosmos, the interchain king?

From late 2024 to early 2025, the Cosmos ecosystem has attracted considerable attention—though not for positive reasons.

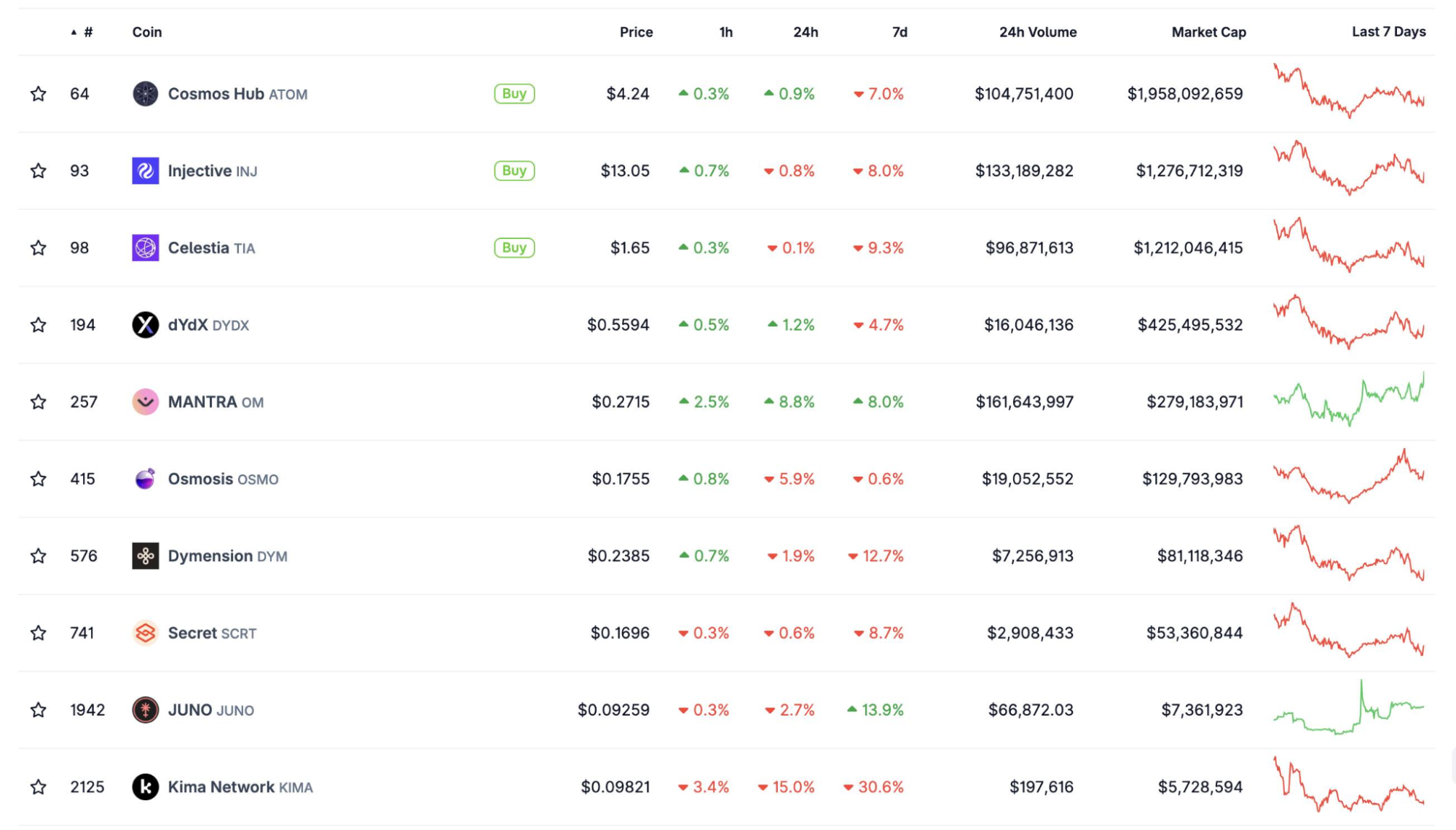

By August 5, 2025, the price of Cosmos’s core token ATOM had dropped to $4.20, marking a staggering 90% decline from its peak. Since the end of 2024, leading projects like Osmosis (OSMO) are down 79%, JUNO has collapsed by 82% to near zero, and even the relatively strong Injective (INJ) fell from $34 to just around $12. Across the board, tokens such as Kava, Evmos, Cronos, and Fetch.AI have seen widespread losses.

Back in 2022, Cosmos defied the market downturn, ranking second in TVL. Today, however, it faces unprecedented value erosion. Once regarded as the backbone of blockchain interoperability, what has changed within the Cosmos ecosystem? How did Cosmos go from a standout DeFi darling in 2021 to today’s market underperformer? What’s driving this dramatic shift?

A closer look at recent performance reveals deeper forces behind this crash—far beyond routine market fluctuations.

Airdrop Frenzy and the Death Spiral

In early 2024, news of the Celestia (TIA) airdrop swept through the crypto community. Few anticipated that this wave of free tokens would mark the beginning of a nightmare for the Cosmos ecosystem.

Celestia is a modular data availability network built on the Cosmos SDK, deeply integrated with the Cosmos ecosystem via the IBC (Inter-Blockchain Communication) protocol.

Just a year earlier in spring, TIA surged to a high of $20.17, and social media buzzed with stories of overnight millionaires. But the party lasted just two months before a ferocious sell-off began: TIA plummeted by 91.9%, now hovering near $1.60.

This dramatic collapse echoed across the entire Cosmos ecosystem.

The Celestia airdrop event perfectly captured the “hype-to-dump” cycle plaguing Cosmos. When airdrop news hits, speculators rush in, driving prices up and creating the illusion of vibrant growth.

Yet this kind of expectation-driven, rather than fundamentals-driven, rally is unsustainable. Early holders inevitably cash out, triggering a drop in prices, widespread panic, and a larger wave of selling—ending in a collapse.

Osmosis followed a similar trajectory during the 2022 liquidity mining boom, dropping from a high of $11 to just $0.17 today.

Each repetition of this cycle erodes trust and capital, with short-term speculation driving away genuine long-term builders and leaving the ecosystem in a state of instability and volatility.

The Puppet Emperor and a Fractured Kingdom

With the ecosystem’s projects stuck in a vicious cycle, Cosmos’s flagship asset—ATOM—also faces a persistent bottleneck.

In the multi-chain parallel architecture, ATOM’s function as “network fuel” has failed to create a feedback loop. Most subchains have their own native tokens and do not rely on ATOM, making it hard for activity and value to flow back to the core asset.

The high-inflation, unlimited supply model has incentivized staking and governance involvement, but it also applies ongoing downward pressure on token price. Critically, Cosmos’s “build your own blockchain” philosophy promotes innovation and competition but splinters user activity, leaving projects siloed—unlike Ethereum, which locks the majority of ecosystem value into ETH.

ATOM has become a puppet emperor of Cosmos, with governance headaches multiplying and the federation seeing little benefit.

The JUNO incident illustrates these problems: In April 2022, the JUNO community discovered a whale exploiting multiple wallets to circumvent airdrop limits, amassing some $35 million in JUNO tokens.

Following intense debate, JUNO DAO held a vote on Proposal 20 on April 29, 2022, to confiscate those tokens, with the decision taking effect on May 4.

This controversial move fractured the community and badly undermined investor confidence in JUNO’s governance. Governance breakdown failed to address technical or market challenges—instead, it accelerated decline. JUNO’s price plunged from $43 to $0.09—a 99% loss.

Yet these are far from Cosmos’s only concerns, or even issues unique to Cosmos.

Multi-Chain Ecosystems: A “Midlife Crisis”

When we discuss Cosmos’s plight, we’re really exposing the deep anxiety facing all multi-chain ecosystems—a persistent gap between technical innovation and real market adoption.

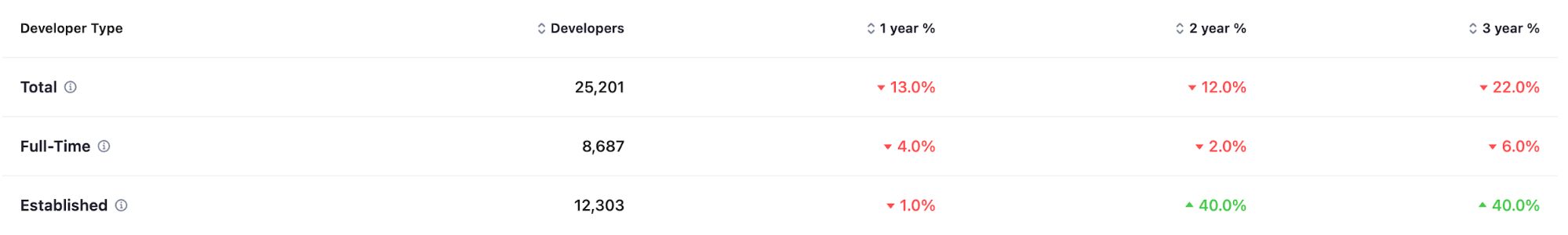

In April 2025, Cosmos topped all blockchain projects in developer activity. Yet, this perceived progress masks an unmistakable decline in active developer participation across crypto.

Source: developer report

Other ecosystems have also slowed: Ethereum’s developer count dropped 2.54%, BNB Chain fell 9.45%, Polygon, Arbitrum, Optimism, and Avalanche declined 10.35%, 7.62%, 6.82%, and 12.08%, respectively.

Polkadot ranks tenth, with 3,400 developer activities, and contributor numbers declined 0.91% to 325. Facing the slow JAM upgrade and intensifying competition, Polkadot’s community even issued an urgent “React or die” call.

Multi-chain systems face common structural challenges:

- Missing network effects: Unlike Ethereum, these ecosystems lack enough users and viable applications to create a self-sustaining cycle.

- Weak developer incentives: Despite technical sophistication, economic rewards are often insufficient to attract and retain top talent.

- Unclear market positioning: Competing against Ethereum, they often boast technical superiority but lag in meaningful adoption.

Current market dynamics only intensify these challenges.

In Q2 2025, total crypto market capitalization topped $3.5 trillion, but this surge was fueled by institutional capital—investors seeking risk control, liquidity, and regulatory compliance.

For institutions looking for stable returns, Bitcoin and Ethereum are more attractive than experimental multi-chain projects. This capital shift is further marginalizing multi-chain projects both in fundraising and liquidity.

On top of that, growing institutionalization has triggered an unexpected “Matthew effect” in infrastructure development—winners continue to pull ahead.

Stablecoins have become fundamental infrastructure linking traditional finance with crypto, but development centers on mature networks. As stablecoins become as essential as utilities in the new financial system, multi-chain ecosystems find themselves sidelined.

This predicament is forcing these networks to rethink their value proposition—moving beyond tech race towards practical user experiences and real-world adoption.

This strategic pivot isn’t just vital for survival—it may spark the next innovation cycle.

Crossroads: Rebirth or Decline

As of 2025, Cosmos stands at a pivotal crossroads.

Since its 2019 mainnet launch with visions of blockchain-powered internet, through the 2021 interoperability craze when ATOM hit $44.70, to the deep introspection at $3.50 in the 2022–2024 bear market, Cosmos has followed a classic yet distinct journey for a blockchain project.

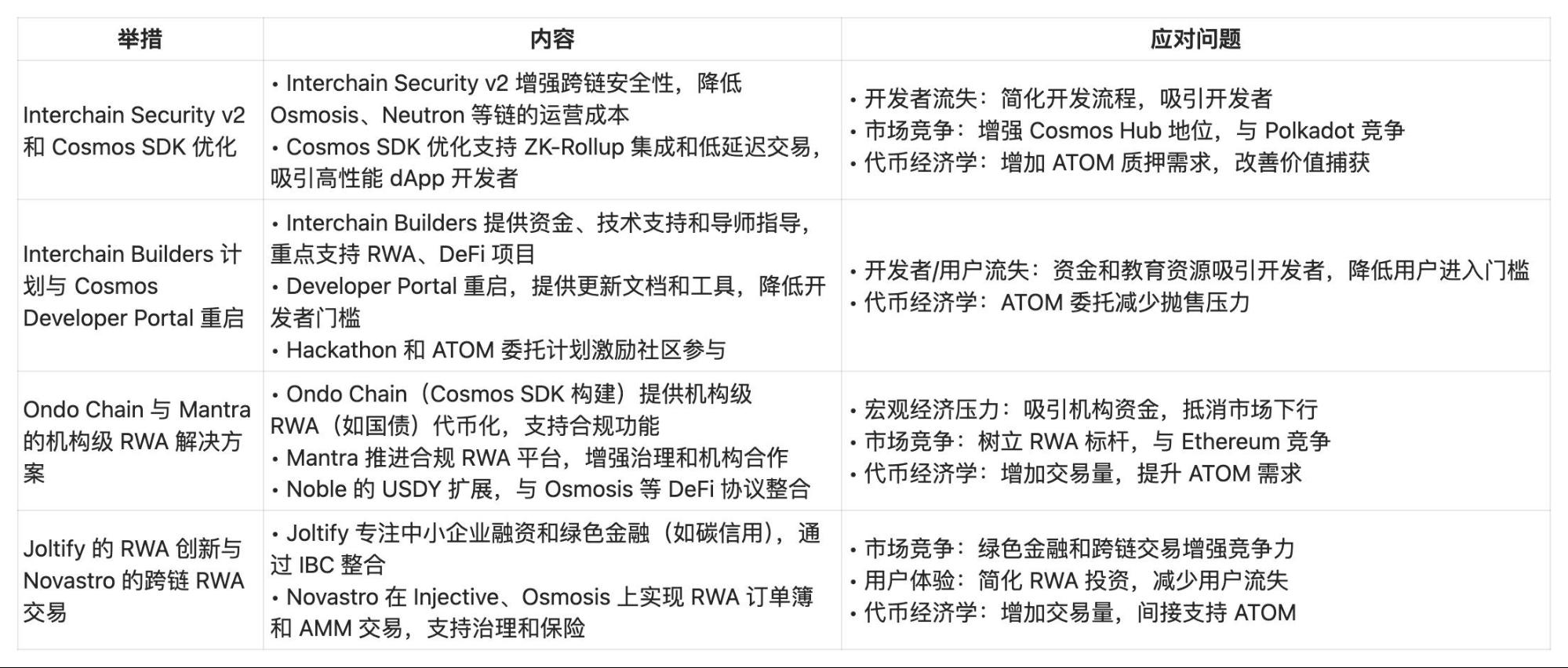

Despite sobering data in these darkest times, Cosmos is in the midst of a profound transformation.

Outlooks for Cosmos (ATOM) remain diverse. Short-term forecasts are divided: CCN and Changelly are bearish, citing technical indicators (like RSI and moving averages), while CoinLore and CryptoNewsZ remain bullish, expecting prices to break out above $20–$40.

As the future remains uncertain, ecosystem expansion, technical upgrades, market sentiment, regulations, and competitive threats all play prominent roles in decision-making.

It’s critical to recognize that the true effects of technical and governance reforms take time to validate.

Competition from Layer-2 solutions and other interoperability protocols persists, while Federal Reserve policy and geopolitical risks continue to impact the broader crypto market. Most importantly, the ongoing shift from idealism to pragmatism is a painful but necessary process—requiring a delicate balance between innovation and market realities.

History shows the greatest technologies and ecosystems often emerge from moments of crisis. Cosmos, too, will need time to reveal whether its future is revival or darkness.

Disclaimer:

- This article is republished from [TechFlow] and is the property of the original author [Yanz]. If you have concerns about this republication, please contact the Gate Learn team, who will promptly address the issue according to established procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- The Gate Learn team prepared translations for other language versions of this article. Reproduction, distribution, or plagiarism of the translated article is prohibited unless Gate is cited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge